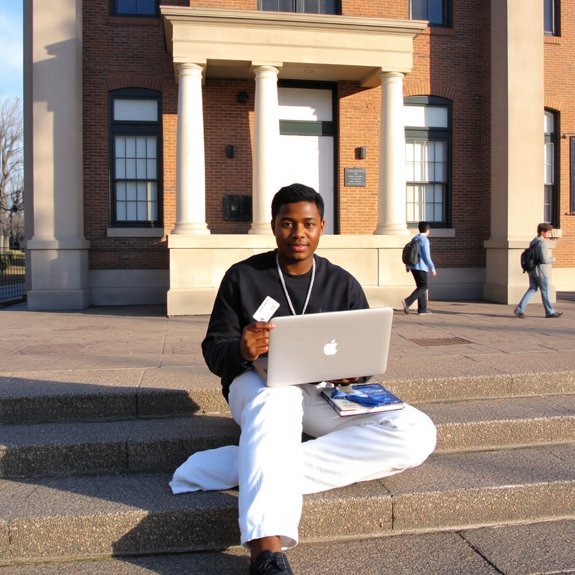

You’re on campus, juggling classes, late-night wings from the cafeteria, and a future you want to afford — so let’s get your credit right. Start small: a student or secured card from the campus bank, pay every bill on time, keep balances low, and talk to the financial aid office (they actually know stuff). I’ll show you how to build history, avoid rookie mistakes, and turn tiny wins into real options — but first, one thing most students miss.

Key Takeaways

- Open a student or secured credit card and use small monthly purchases paid in full each month to build on-time history.

- Keep credit utilization under 30% (aim for 10%) by charging little and paying balances before statement closing.

- Report and monitor your credit regularly using free annual reports and campus financial resources to spot errors or fraud.

- Automate payments, sync due dates with payday, and set reminders to avoid late payments that damage scores.

- Use campus banks, credit unions, workshops, and mentors for low-cost credit-builder products and budgeting support.

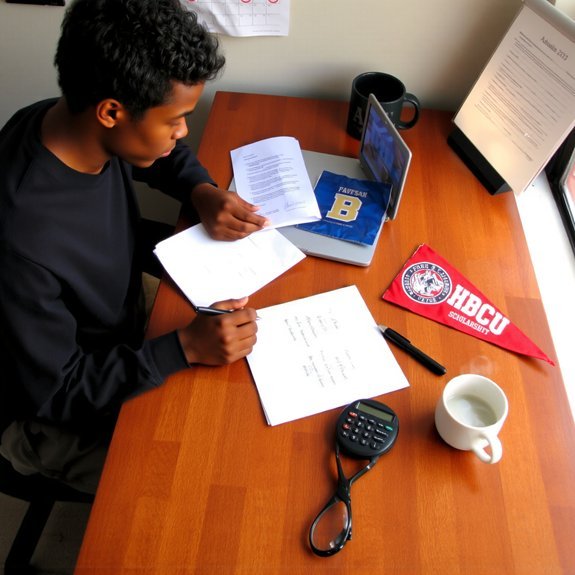

Why Building Credit Matters as an HBCU Student

If you’re juggling classes, campus vibes, and a social life that refuses to slow down, building credit might not feel urgent—until you want an apartment, a car, or a phone plan that doesn’t come with a lecture. You’ll thank me later when landlords nod instead of squinting, when dealers stop asking if you’ve got a cosigner, when that silky phone upgrade lands in your palm. Picture signing a lease, the smell of new paint, keys cold and real. You’ll want options, power, control. Good credit turns small wins into choices, it cushions surprises, it saves cash on interest — boring but true. Start early, steady, and with a little swagger; adulthood’s less scary that way.

Understanding Credit Basics: Scores, Reports, and What Lenders See

You’re about to see how a few numbers and pages actually run your financial life, and I promise it’s less boring than it sounds. I’ll walk you through what makes up your credit score, how to pull and read your report, and what lenders peek at when they decide to say yes or no — picture me with a flashlight pointing at each line item, goofy grin included. Stick with me, ask the obvious questions, and we’ll turn that mysterious report into something you can use, not fear.

Credit Score Components

Once you start hearing lenders talk about “scores” like they’re secret passwords, I want you to relax and lean in—because the truth is, your credit score is just a snapshot, a loud little number that tells banks how reliable you look. You’ll want to know what builds that noise. I’ll walk you through the pieces, like a playlist of habits: some upbeat, some slow, all testable. Picture a mixer board, knobs you can turn. Tidy habits raise volume, messy ones muffle it. You can tweak these today, literally, with a payment tap or a quick balance check.

- Payment history: on-time beats late, every time.

- Credit utilization: keep balances whisper-quiet.

- Length of credit: older accounts hum steady.

- New credit: too many pulls sound alarmed.

- Mix of credit: varied tracks show experience.

Credit Report Checks

Because your credit report is basically the backstage pass lenders peek at, you should check it like you’d check a group chat—often, casually, and with snacks nearby. I tell you, log in, breathe, scan the names, balances, and dates, like spotting receipts in a messy dorm drawer. Pull reports from the three bureaus, stagger them over the year, and set calendar reminders. Look for wrong addresses, accounts you don’t recognize, or late payments that make no sense. If something’s off, call, dispute online, snap screenshots, follow up, and don’t be shy—companies answer faster when you’re persistent. Keep notes, keep copies, and celebrate small wins with a victory snack. You’ve got this, one tidy report at a time.

Lender Decision Factors

Nice job checking your reports—now let’s peek at what lenders actually care about. I’ll be blunt: they’re not judging your playlist, they’re reading numbers and patterns. You’ll want to show steady payments, low balances, and few recent inquiries. Imagine a tiny, picky auditor sniffing your file; you can make it smell like responsibility, not chaos. Pay on time, keep utilization low, avoid opening cards willy-nilly, and explain any hiccups.

- Payment history: consistent, on-time beats loud excuses.

- Credit utilization: keep it low, like a calm kitchen counter.

- Length of history: older accounts sing reliability.

- Recent inquiries: too many look like financial stress.

- Mix of credit: a little variety helps, don’t overdo it.

Do this, and lenders nod, you win.

Student-Friendly Credit Products: Cards, Secured Options, and Retail Accounts

You’re about to meet the credit tools that actually get you: student cards with small limits that report on-time payments, secured cards that turn your deposit into borrowing power, and those tempting retail accounts that can be useful if you don’t go wild. I’ll say it plain, I’ve opened a thrift-store-smelling secured card before, felt weird handing over a $200 deposit, then loved watching the score inch up as I paid on time. Stick with low balances, set calendar reminders, and don’t treat store credit like free money — your future self will thank you.

Student Credit Cards

If you’re new to credit, welcome to the small-but-mighty world of student cards, where plastic can feel like a cape and your future self gives you a grateful high-five; I’ll show you the ropes. You’ll pick a beginner-friendly card, charge something tiny—coffee, snack—pay it off, and watch your score creep up like sunlight across a dorm wall. Don’t max out the card, don’t ghost your payments, and do treat statements like tiny treasure maps.

- Pick a card with no annual fee, clear terms, and a decent grace period.

- Use autopay for the minimum, then pay extra when you can.

- Keep utilization under 30%, aim lower.

- Monitor your credit report monthly.

- Avoid cash advances and late fees.

Secured Card Basics

Student cards are great for practice, but when you want something tougher and safer—enter the secured card. You put down a cash deposit, like laying a small bet, and that deposit becomes your credit limit; it’s tactile, you feel the weight of responsibility in your wallet. Use it for gas, snacks, or that textbook, pay on time, scores go up. I’ll be blunt: missed payments sting, they leave marks. But on-time habit builds muscle, and you’ll hear the sweet ping of score gains. Many issuers report to all three bureaus, so your effort matters. When you’re ready, ask for a limit increase or upgrade; sometimes they’ll say yes, with a little cheer and a tiny high-five from your future self.

Retail Store Accounts

When you wander into a campus bookstore or a mall kiosk and they hand you a little pamphlet promising discounts, that’s a retail store account waving at you like an enthusiastic salesperson—so listen up. You’ll get targeted deals, a shiny card, and tempting “today only” lines. Use one for small, planned buys, pay on time, and it reports to the bureaus—your score thanks you later. Don’t max it, don’t ignore fees, and don’t let curiosity turn into impulse debt. I’ve watched friends grab jackets on impulse, then sulk at statements; learn from them, not me.

- Start small, use for essentials you’d buy anyway

- Pay full balance each month, avoid interest

- Watch for hidden fees, read the fine print

- Track billing cycles, set calendar reminders

- Close only after paying and checking credit reports

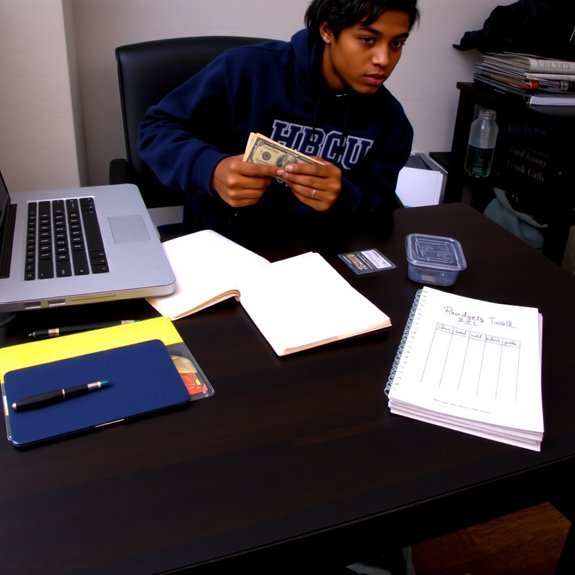

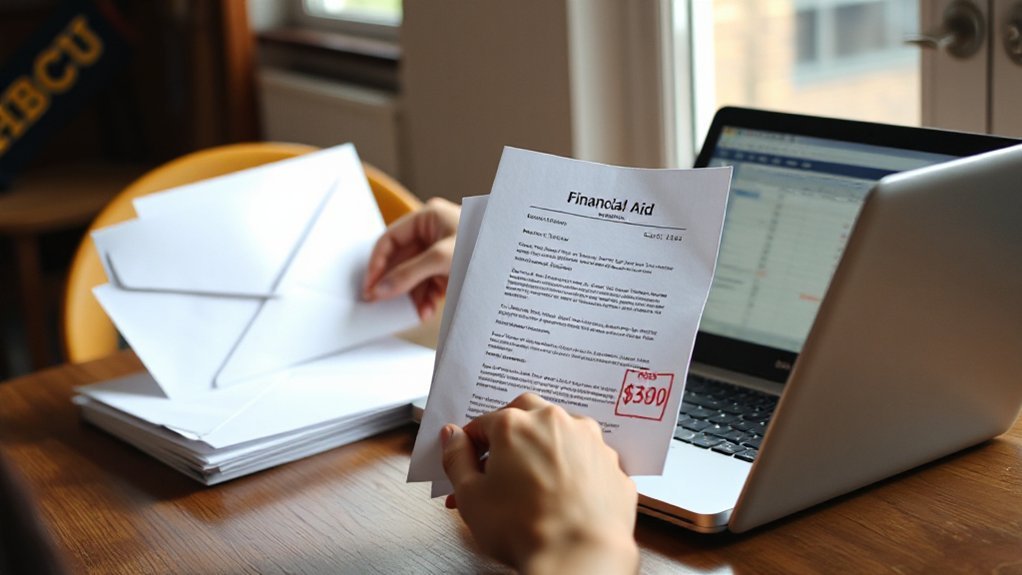

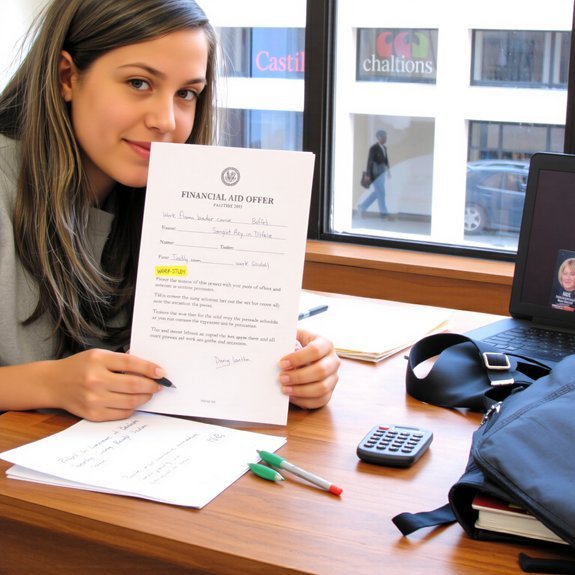

Using On-Campus Financial Tools to Establish Credit

Because campus life throws you into a tiny economy—cafeteria coffee that tastes like regret, campus bookstore lines, and dorm laundry that never ends—you’ve got a perfect, low-stakes lab to start building credit. You can use the student credit-builder card from the campus bank, open a secured account at the credit union, or link a campus prepaid card that reports activity. I’ll walk you through quick wins: set small, regular purchases, monitor the bank app like it’s a gossip thread, and ask the teller to report positive history. Try student installment plans that report payments, but keep amounts tiny. Talk to the financial office, they’re friendlier than you expect. These tools teach routine, show lenders you’re responsible, and keep risk low while you learn.

Paying Bills and Loans on Time: Habits That Build Score and Discipline

You’ve already practiced small, reportable spending on campus—now let’s make those tiny victories count by paying things on time, every time. I’ll call out habits you can adopt today, no drama, just discipline. Set phone alarms that buzz like a nagging roommate. Automate minimums, then add a little extra, like tipping your future self. Track due dates on a colorful calendar, feel the satisfaction of crossing them off. If cash gets tight, call the lender—people answer, and plans exist.

- Sync payment dates with payday, so you never scramble.

- Use autopay for essentials, check monthly like a curious detective.

- Keep a small emergency fund, two spaghetti dinners’ worth.

- Set calendar reminders three days ahead, then one day.

- Celebrate each on-time month, popcorn and proud smiles.

Managing Credit Utilization and Avoiding Common Pitfalls

If you keep credit cards as tiny tools instead of giant temptations, your score will thank you — and so will your future self when rent day rolls around. I want you to treat utilization like a smoothie recipe: a little credit, lots of cash, blend. Keep balances under 30% — I aim for 10% — and watch that number breathe. Check statements, set alerts, and pay twice a month if your paycheck schedule is messy. Don’t close old cards; age matters like vintage sneakers. Beware cash advances, late fees, and the “just this once” impulse, they smell like regret. If you slip, call the issuer, negotiate fees, fix it fast. Small rituals, daily checks, steady wins the credit race.

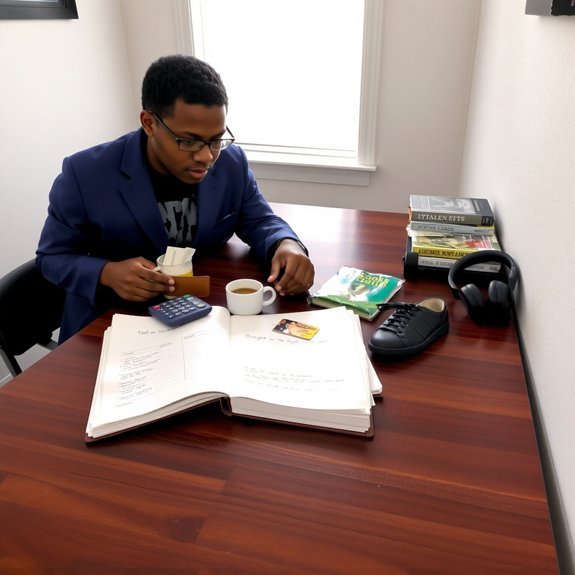

Leveraging Campus Resources: Financial Aid Offices, Workshops, and Mentors

Keep that low-utilization habit rolling, but don’t go it alone — campus has a whole backstage crew ready to help you. I pop into Financial Aid, feel the cool hum of fluorescent lights, and ask the awkward questions, the ones that actually matter. You’ll find workshops that smell like coffee and confidence, where counselors walk you through credit basics, step by step. Grab a mentor, someone who’s been broke and bold, who texts real talk and hands you a budget template. Use student services to practice calling creditors, role-play, and build nerve. Sign up, show up, and take notes. You’re not nagging—you’re networking, learning, and slowly turning small choices into big credit wins.

- Visit Financial Aid for credit-friendly guidance

- Attend credit workshops, bring a notebook

- Pair with a mentor, ask blunt questions

- Role-play calls in student services

- Use campus tools: budgeting apps, templates

Protecting Yourself: Identity Theft, Scams, and Responsible Credit Use

While you’re juggling classes and meal swipes, don’t let your guard down—identity thieves love campuses the way squirrels love birdfeeders. I’m telling you, lock your laptop, stash receipts, shred bank mail. Check your credit report, set alerts, freeze accounts if something smells off. Don’t tap unknown Wi‑Fi, don’t click “too good to be true” scholarship emails, and don’t share SSN or card numbers over text. Use strong passwords, a password manager, and two‑factor authentication; they’re tiny armor, trust me. If a scam hits, call your bank, report to campus police, and file a fraud alert. Pay bills on time, keep balances low, and treat credit like a tool, not a toy. You’ve got this — protect your future, one smart choice at a time.

Transitioning From Student to Graduate: Maintaining and Growing Credit After College

You’ve already locked your laptop and shredded that mystery mail, so let’s talk about what comes next: leaving campus doesn’t mean leaving your credit behind. You’ll walk into new routines, rent inspections, and a mailbox that isn’t a dorm cubby. I’m right here, nudging you: keep autopay on, update your address, and don’t ghost your cards. Picture the relief of a paid balance, the tiny thrill when your score ticks up. It’s not sexy, but it works.

- Check your credit report yearly, dispute errors fast.

- Convert student cards to regular ones, keep history.

- Build an emergency fund, three months is comfy.

- Use one card for bills, pay in full, no drama.

- Try a secured loan or credit-builder, small wins stack.

Conclusion

You’ve got this — treat your credit like a garden: plant small, water it daily, don’t stomp on the seedlings. I’ll nag you: pay on time, keep balances low, use campus tools, ask for help. Imagine the relief when lenders nod, doors open, and your future smells like fresh-printed diploma. It’s steady work, not magic. Be curious, be careful, laugh at mistakes, then fix them. Grow it slow, and watch opportunity bloom.