Most people underestimate how much they actually spend on little things — that latte and those three streaming trials add up fast. You can fix that without turning your life into bean-counting misery; start by logging every dollar for a month, feel the tiny shocks when you tally it, and decide what matters. I’ll show you how to set goals, carve categories, build an emergency cushion, and slay debt, so you end the year richer and calmer — but first, we pick a starting date.

Key Takeaways

- Tally all income (steady and sporadic) from paystubs and side gigs to know your real monthly cash flow.

- Review three months of bank statements to categorize spending (groceries, subscriptions, takeout, impulse purchases).

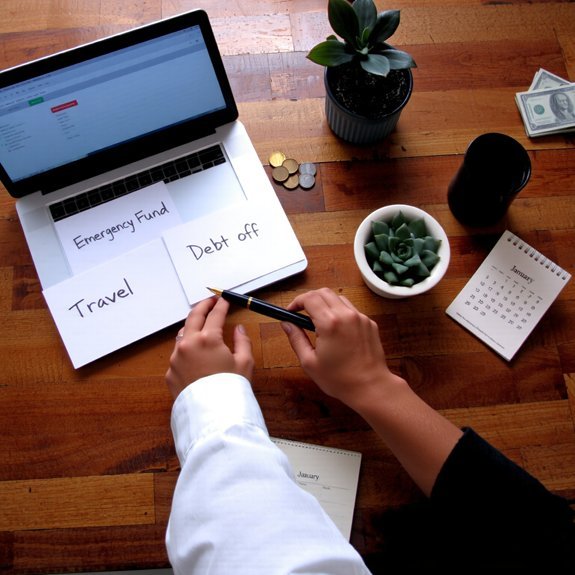

- Set 2–4 specific financial goals for the year with amounts and deadlines (emergency fund, debt payoff, vacation).

- Assign spending limits to each category, automate savings transfers, and prioritize high-interest debt repayment.

- Monitor weekly, review monthly, and adjust limits or goals while celebrating milestones to stay motivated.

Assess Your Current Income and Spending

Alright — let’s pull up your financial receipts and stop pretending the missing dollars are living a secret, glamorous life. You’ll list every income sources, paystub and side gig, feel the weight of paper and glowing app balances in your hands. I’ll nudge you: sort steady versus sporadic, circle totals, breathe. Then we’ll track spending habits — groceries, late-night takeout, subscriptions you forgot, that one chaotic impulse buy. Open bank statements, tap through three months, narrate what each charge tastes like (yes, your latte smells like regret). You’ll map money on a table, sticky notes like tiny boats, label leaks and anchors. It’s honest, tactile work, a little mortifying, oddly freeing — you’ll know where to steer.

Define Your Financial Goals for the Year

Once you’ve faced the receipts and named the leaks, it’s time to tell your money where it’s allowed to go this year — and I promise, you can be both ambitious and reasonable. Start by naming your financial aspirations out loud, like a weird pep talk to your wallet. Say “emergency fund,” “vacation,” “debt-free,” whatever, and put timelines on them. Pick 2–4 yearly objectives, one short-term, one mid, one bold long-term. I suggest you write them down, feel the paper under your fingers, imagine the trip or zero balance, then prioritize. Be specific: amounts, deadlines, and a tiny reward when you hit milestones. Keep the goals flexible, revisit monthly, and don’t guilt-punish yourself — budgets are maps, not moral verdicts.

Categorize Expenses and Set Spending Limits

Good—now that you’ve named the goals and given them deadlines, it’s time to decide what gets the money. You pull out last month’s bank statements, spread them like evidence on the kitchen table, and sort transactions into neat expense categories: rent, groceries, transport, subscriptions, fun. I nudge you to be honest—yes, even about that streaming pileup. For each category, set clear spending limits, a number you can live with and defend. Start tight where you can, leave breathing room where life surprises you. Tape the limits on the fridge, or set alerts on your phone, whatever wakes you up to reality. Review weekly, trim what leaks, reward small wins. You’ll feel lighter, in control, maybe even smug—guilt-free.

Build an Emergency Fund and Plan for Savings

If your budget is a map, consider an emergency fund the little bunker you hide your snacks in when the road goes sideways—I start mine by picturing the worst mildly plausible surprises, the car cough that turns into a tow, the furnace that gives up on a January morning, the sudden vet bill that makes you speak in capitals; then I set a weekly auto-transfer so saving feels like brushing my teeth, boring but non-negotiable, and I watch the number grow like a stubborn but obedient garden, green and reassuring. You’ll pick a target, three to six months of basics, then automate deposits into a separate account. Make a simple savings plan, label it clearly, and celebrate tiny milestones. Treat it like insurance you can hug.

Create a Debt-Repayment Strategy

Okay, here’s the plan: you’re going to attack the highest-interest balances first, like a stingy landlord collecting rent, while still keeping every other account’s minimums humming along. I’ll walk you through a simple payment schedule that shows exactly how much to send where, when, and why it makes your wallet breathe easier. Roll up your sleeves, grab a calculator or your phone, and let’s watch those interest charges shrink.

Prioritize High‑Interest Debt

Three simple rules: find the highest-rate debt, attack it like it insulted your coffee, and don’t stop until it’s toast. I tell you this because interest rates are the sneaky gremlins that eat your budget while you sleep. Look at each account, feel the sting when you see that APR, then point your money at the worst offender. You can use debt consolidation if it lowers the rate and simplifies bills, but don’t trade one monster for another. Make a plan that feeds extra dollars to that hot spot, visualize shredding statements, celebrate small victories with a silly fist pump. Keep a running tally, adjust as rates change, and stay ruthless with new charges. You’ll sleep better, I promise.

Build Minimum Payment Plan

Start with one simple promise: you’ll pay every minimum on time, every month, no excuses — even if it means eating instant ramen for a week. I’m with you, fork in hand, mapping out minimum payment strategies that keep lights on and stress down. First, list due dates, amounts, and interest rates, feel the relief when you see the whole picture. Automate where you can, set calendar pings for the rest. Then carve a tiny cushion, budgeting for flexibility — a $25 buffer can feel like a safety net. If a surprise hits, shift a nonessential meal out, not your mortgage. Say the tough no, reallocate that cash, watch balances breathe. Little steady moves win.

Track Progress and Adjust Your Budget Regularly

You’re going to check in every month, open your app or stack your receipts on the counter, and actually see what’s changed. Compare your goals to reality—if your savings aren’t growing like you planned, don’t feel bad, tweak the plan and reallocate funds where they’ll do the most work. I’ll hold you accountable with a nudge, you make the adjustments, and together we’ll keep this budget breathing.

Monthly Check-Ins

If you want your budget to actually work, check it every month—really look at it, like opening the fridge to find that mysterious jar of salsa. I sit down with my statement, a mug of coffee, and a pen; you should, too. Monthly accountability keeps you honest, it’s a tiny ritual that stops creep. Do quick financial reflections: what surprised you, what felt tight, what bought joy? Mark categories that blew up, highlight savings wins, and jot one tweak. Say aloud, “Okay, less takeout,” like a tiny promise. Close the file, feel lighter. If something needs bigger change, schedule it for a review, don’t panic now. Repeat, tweak, celebrate small victories — you’ve got this.

Compare Goals vs. Reality

When your goals and your bank account start arguing, don’t be a silent referee—pull up a chair, open your budget, and play detective. I want you to scan last month like a crime scene, smell the coffee, feel the receipts, note where intentions faded. Do a reality check: did you hit savings targets, or was impulse shopping louder than your well-meaning plan? Check goal alignment by lining each expense against a specific aim—emergency fund, vacation, debt payoff. Say it out loud, “Did I actually pay toward that?” Listen, adjust expectations, not morale. Mark wins, tiny and big, then note leaks. Be blunt, shrug when needed, laugh at mistakes, and record one clear tweak before you close the file and move on.

Reallocate Funds as Needed

Because budgets are living things, not stone tablets, I check mine like a nosy neighbor peeking through blinds—regularly, close, and with a little guilt. You’ll do the same. Track spending weekly, scan receipts, and listen for wobble in your cash flow. When a category overruns, make budget adjustments fast: trim dining out, shift a surplus from groceries, or pause a subscription with the flair of a magician vanishing a rabbit. That gives you financial flexibility without panic. Say aloud, “This month I move $50 from fun to rent,” and do it. Reallocate funds, set a brief trial period, then reassess. Small experiments teach more than heroic vows. Stay curious, honest, and a little ruthless. Your future self will thank you.

Conclusion

You’ve got this—really. I’ll say it: your budget won’t be boring, it’ll be your financial superpower, louder than a brass band. Start by checking last month’s receipts, feel the paper, then set one clear goal and guard it like treasure. Automate savings, chop one needless subscription, and pay extra on the highest-interest debt. Check in weekly, tweak when life shifts, and celebrate small wins with something you actually enjoy.