You want a cheerful holiday without the post-party regret, and I’ll show you how to get there without turning your wallet into confetti. Start by picking a firm total you can live with, split it into gifts, food, travel and “oops” money, then rank who really needs something and who can get a card. I’ll walk you through price caps, clever swaps, and a tracking system that actually works — but first, pick your number and don’t panic.

Key Takeaways

- Set a firm total holiday spending limit tied to your financial goals and write it down on your phone for commitment.

- Break the total into categories (gifts, food, travel, wrapping, charity) and assign a dollar amount to each.

- Rank recipients by closeness and set per-person price caps, allowing room for one or two special splurges.

- Plan meals, parties, and travel in advance, assign dishes or compare transport options to minimize costs.

- Track every purchase daily, adjust category allocations as needed, and keep receipts to avoid overspending.

Set an Overall Holiday Spending Limit

Okay — let’s pick a number. You’ll start by deciding a firm total for holiday expenses, that round, honest figure that makes your stomach flutter and your planner breathe easier; I’ll whisper suggestions, you’ll nod, we’ll both win. Imagine laying bills on the table, paper rustling, coffee steam curling, and saying, “This is it.” Tie that number to your financial goals — debt reduction, savings, or a guilt-free splurge — and let it steer choices. Write the limit down, lock it in your phone, and announce it aloud like a quirky campaign slogan. If you wobble, revisit priorities, trim wants, boost small joys, and remember: you control the list, not the commercials.

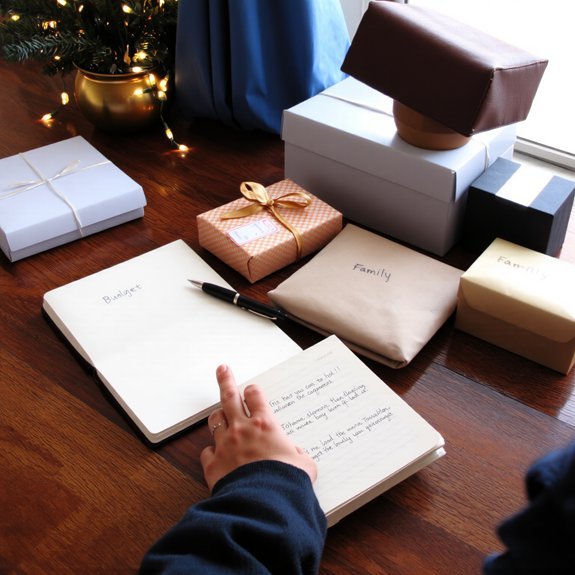

Break the Budget Into Categories

Sooner rather than later, you’ll want to chop that big, scary total into bite-sized pieces, and I’ll show you how — think of it like carving a roast, but with receipts and glitter. Start by listing gift categories: family, friends, coworkers, teachers, charity, wrapping, and holiday meals. Say each one out loud, tap the table, make it real. Assign a rough budget allocation to each category, based on who gets what and how much joy you expect. I’ll admit, this feels bureaucratic and slightly magical. Use cash envelopes or separate spreadsheet columns, label them, and hear the satisfying thunk when you close a category. Adjust as you shop, trim where you must, and celebrate small victories with one tiny, well-earned peppermint.

Prioritize Gifts and Recipients

Now that your categories are sitting in neat little envelopes or spreadsheet cells, it’s time to decide who actually gets the good stuff. You scan your recipient list like a general planning a snack raid: parents, kids, coworkers, that neighbor who borrows sugar. Use simple gift prioritization—rank by closeness, obligation, and joy delivered. I tell you to be ruthless, in a warm way. Touch each name, imagine unwrapping, hear the crinkle. If someone sparks a grin, bump them up. If they’ll do fine with a card, downgrade. Set limits per tier, write price caps next to names, then total it. You’ll save money, stress, and dignity. Also, you’ll still get to splurge on that one delightfully ridiculous present.

Plan for Food, Parties, and Travel Costs

When you add food, parties, and travel into a Christmas budget, the numbers start to smell like cinnamon and stale airport coffee, and you can’t just wing it. You’ll map meals first, list staples for grocery shopping, and chunk costs per person, because surprise side dishes kill budgets. For party planning, pick a theme, set a guest cap, and assign dishes — potluck saves cash, and someone will always bring the jelly. For travel, compare drives, trains, and cheap flights, factor luggage fees, and pencil in buffer cash for delays. I’ll poke at receipts, haggle with vendors, and pack snacks so you don’t blow money on snack-bar regret. Simple steps, less stress, and you actually enjoy the holiday.

Track Spending and Adjust as Needed

If you want to keep your Christmas budget from mutating into a glitter-covered horror show, you’ve got to track every cent like it’s a suspicious elf, and yes, I mean every latte and leftover candy-cane receipt. You’ll keep spending logs, you’ll glance daily, you’ll spot leaks before they become tidal waves. I talk to my list like it’s a tiny, judgmental accountant.

- Record purchases immediately, phone app or notebook, don’t wait.

- Categorize each line: gifts, food, travel, misc.

- Compare actuals to estimates every 3–5 days.

- Make quick budget revisions when patterns pop up, cut one nonessential.

- Keep receipts handy, photograph faded ones, and celebrate small wins.

You’ll stay calm, smug, and in charge.

Use Saving Strategies and Smart Shopping

I’ll tell you the short plan: start a gift savings jar or automatic transfer, watch it grow like a slow-but-satisfying snowball, and pat yourself on the back. Hunt deals and clip coupons, snag generics when the label looks the same, and buy bulk basics—think wrapping tape and pantry staples—to cut surprise costs. You’ll feel smarter at checkout, lighter in January, and a tiny bit smug, which is absolutely allowed.

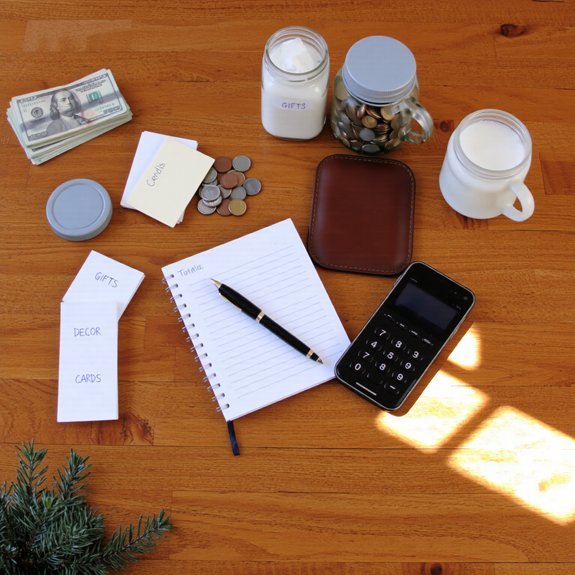

Start Gift Savings Plan

Because your future gift-haul shouldn’t come as a panicked sprint through a crowded mall, let’s make a plan that actually feels doable and maybe even a little fun. You’ll stash cash regularly, watch it grow, and feel smug sipping cocoa while others scramble. Gift savings and holiday planning start with small, steady moves. I’ll show you how to make it painless, even enjoyable.

- Open a separate “gifts” savings account, automate transfers each payday.

- Set target amounts per person, write them down, stick a sticker on the jar.

- Use a calendar, map out buying dates, avoid last-minute chaos.

- Round up purchases or save spare change, treat it like found money.

- Review and adjust monthly, celebrate milestones with a tiny reward.

Shop Deals and Coupons

You’ve been squirreling away cash and ticking names off your list, now let’s make that money stretch—like, elastic-band-around-a-bunch-of-gifts stretch. Hit apps and store sites, smell virtual sale banners, compare prices fast. I’ll show you coupon stacking tricks that turn a ten-dollar voucher into a twenty-dollar win, yes really. Clip manufacturer coupons, add store codes, and watch totals sag. Scan for holiday promotions, join email lists, and set alerts — you’ll get early access, flash deals, and that sweet checkout thrill. Keep a running list, timestamp bargains, and don’t buy on FOMO. If a price drops, ask for an adjustment, be polite, be persistent. You’ll shop smarter, laugh at your old impulse buys, and keep more cash for cocoa.

Buy Generic, Bulk Items

When you swap brand-name bravado for the generic aisle, your wallet breathes out a long, grateful sigh—like someone finally opening a window after holiday cookie fumes. You’ll find generic products that look the same, taste close enough, and cost way less. I nudge you toward bulk purchasing for items you actually use—wrap, batteries, napkins—because buying once, not twice, feels glorious.

- Buy gift wrap rolls in bulk, stash in a closet.

- Choose store-brand batteries, label with sharpie.

- Grab snack packs for stockings, freeze extras.

- Pick generic candles and soaps, they scent the room.

- Shop bulk toiletries, split costs with friends.

You’ll save money, time, and holiday stress. Trust me, your future self will thank you.

Conclusion

You’ve got this—you’ll set a spending limit, slice it into categories, and crown top gift recipients like a boss. I’ll cheer you on as you nab deals, stash receipts, and pivot when plans wobble. Picture jingling coins turning into warm dinners and surprised faces, smell the cinnamon, feel the paper tape. Keep tweaking, celebrate small wins, and don’t beat yourself up. Budgeting’s not a prison, it’s your ticket to a calm, merry season.