You’ll track the bills, you’ll track the wins, you’ll learn to stretch a dollar till it sings. I’ll walk with you—practical steps, blunt truth, a few jokes when the budget gets ugly—so you can spot grants, dodge junk fees, and still eat ramen that doesn’t taste like cardboard; picture late-night FAFSA clicks, sticky campus flyers for scholarships, and a thrift-store backpack that proves you’re stylish on a budget. Keep going—there’s a plan.

Key Takeaways

- List fixed and variable costs, then build a monthly budget tracking income, expenses, and an emergency fund.

- Complete the FAFSA, apply for grants and HBCU scholarships, and meet with financial aid for work-study options.

- Save on textbooks by renting, buying used, or borrowing from classmates and campus resources.

- Choose affordable housing and meal plans, use campus shuttles, biking, or shared rides to cut transportation costs.

- Attend financial counseling, learn loan types, build credit responsibly, and automate small savings each month.

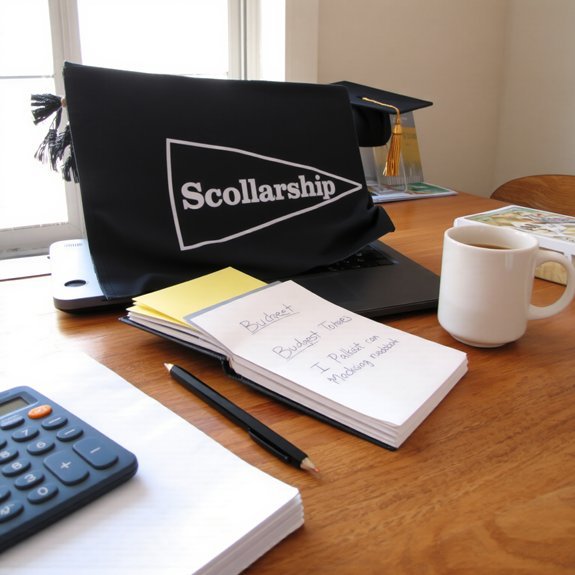

Understanding Your College Costs and Creating a Realistic Budget

Alright, let’s start this money talk like grown folks but keep it spicy: you’re about to map every dollar that’s coming in and every one sneaking out—tuition, room and board, ramen nights, that one “I deserve it” hoodie. I’ll walk you through listing fixed costs first — tuition, housing, meal plan — feel the weight of those numbers, they’re real. Then add variable stuff: groceries, laundry coins, caffeine runs, late-night Uber dramas. Track income: paychecks, parent help, freelance gigs, the occasional tax refund. Build a simple spreadsheet or use an app, color-code it, make it hurt less with visuals. Set realistic limits, earmark an emergency jar, and trim one binge habit. You’ll sleep better, I promise.

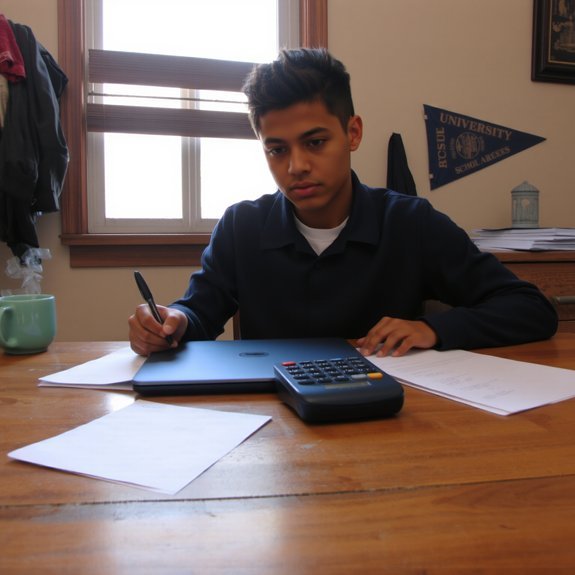

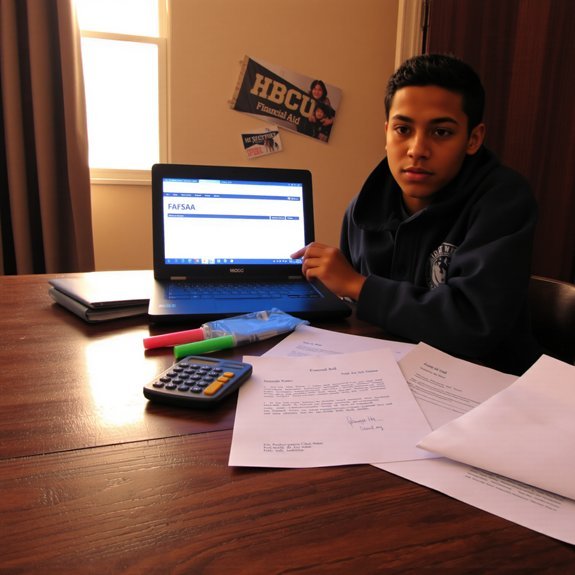

Navigating FAFSA, Grants, and Financial Aid Options

Because money talks louder than vibes on move‑in day, I’m going to walk you through FAFSA, grants, and the other lifelines before you panic and sell your textbooks for snacks. You’ll fill FAFSA online, breathe, hit submit, then check your Student Aid Report like it’s a text from your future. Grants, unlike loans, don’t chase you with interest — Pell, state grants — scoop them up. Talk to your financial aid office, bring ID, tax docs, and questions; they’ll point out work‑study, payment plans, and emergency funds. Keep copies, set reminders for renewals, and appeal if your award feels low — a respectful email can change things. You’ll handle this, one form, one conversation, one relieved exhale at a time.

Finding and Applying for Scholarships for First-Gen and HBCU Students

Where do you start when scholarships seem like hidden treasure and you’re not sure what map to follow? I tell you, first breathe, then hunt. Scan your HBCU’s financial aid page, email the scholarship office, and scribble deadlines in neon. Search databases—Fastweb, College Board, local foundations—and set alerts. Tailor one strong essay, swap drafts with a friend, and save versions; repetition beats panic. Include community work, leadership moments, first-gen grit, and specific campus goals. Ask professors for recommendation letters early, give them bullet points, and thank them with a quick, genuine note. Apply every week, track submissions in a simple spreadsheet, and celebrate small wins—pizza counts. You’ll build momentum, cash, and confidence, in that order.

Saving on Textbooks, Supplies, and Campus Essentials

You worked the scholarship hustle, celebrated with pizza, and padded your bank a bit—good. Now tackle textbooks, supplies, and campus must-haves without crying into ramen. Buy used textbooks online, then list the exact edition in searches, haggle gently, and smell the slightly-steeped paper like victory. Rent books for a semester, scan chapters you need, and highlight digitally. Swap with classmates, post a quick “need/offer” in group chats, and trade like a bargain-savvy pirate. Buy generic supplies—spiral notebooks, pens that don’t judge, a sturdy backpack—and patch tiny tears with duct tape and dignity. Use campus print labs for one-off copies, borrow a calculator, and check freebie tables during move-in. Small savings add up, and you’ll feel clever, resourceful, and a little smug.

Affordable Housing, Meal Plans, and Transportation Choices

If you want to keep rent from eating your scholarship pizza, start by scouting options like a hawk with a backpack. I’ll say it straight: don’t overpay for location pride. Look at rooming with classmates, check campus housing deadlines, and smell-test kitchens before you sign — that burnt-toast smell matters.

- Split utilities and groceries with roommates, set a shared app for bills.

- Compare meal plans, pick one that fits your class schedule, not FOMO.

- Bike or walk short routes, you’ll save cash and get fresh air.

- Use campus shuttles and discounted transit passes, they cut fares fast.

- Negotiate landlord perks, ask for repairs or waived fees, practice your poker face.

You’ll live smarter, eat better, and move cheaper — trust me, it’s doable.

Managing Student Loans and Building a Repayment Plan

Since loans are part of your college soundtrack, learn their beats so they don’t turn into a surprise drum solo when you graduate. I want you to get friendly with interest rates, loan types, and your servicer — touch the paperwork, smell the cafeteria coffee while you read, mark due dates in bold. Sketch a repayment plan: choose income-driven or standard, estimate monthly payments, and build a tiny emergency fund so a missed rent check doesn’t wreck the rhythm. Call your servicer, ask questions, don’t whisper. Reassess annually, refinance only if it lowers rate without losing protections, and track progress with a simple spreadsheet, colorful stickers optional. Celebrate small wins — like shaving off $50 — with a cheap dessert. You’ve got this, drum major.

Earning Income on Campus: Jobs, Work-Study, and Side Gigs

When campus life hands you a schedule full of lectures and late-night study sessions, grab a part-time job and make it sing—I’ve got your back while you learn the ropes. You’ll pick shifts that actually fit, earn cash for ramen and textbooks, and practice punctuality—yes, it’s a flex. I’ll walk you through options, realistic tips, and hustle-friendly habits.

- Campus jobs: library aide, lab assistant, dining hall — low commute, steady hours.

- Work-study: federal aid-based, priority for need, check the financial aid office.

- Tutoring: high demand, you teach, you earn, confidence grows.

- Gigs: campus events, photography, merch sales — flexible, fun.

- Tips: track hours, set earnings goals, balance rest and hustle.

Building Credit and Protecting Your Financial Identity

Because your credit score will follow you longer than that questionable haircut freshman year, you’ve got to treat it like a roommate: polite, responsible, and not stealing your pizza. I want you to open a secured card or become an authorized user on a parent’s card, use it for small purchases, then pay it off, smell the plastic, feel the tiny click of responsibility. Keep balances low, pay on time, set autopay, check your free annual report, and freeze your files if something smells off. Guard your SSN like a key to a secret closet. Shred papers, lock passwords, don’t plug info into sketchy Wi‑Fi. Little habits now build trust later, and yes, future-you will thank present-you with lower rates and fewer headaches.

Campus Resources, Mentors, and Money Habits for Long-Term Success

You’ve got a campus full of hidden allies — the financial aid office with its fluorescent-lit help desk, the student-run credit clinic handing out real-life tips, and emergency funds tucked behind polite smiles — and I’ll show you how to use them. Talk to mentors early, even the professor who knows your name, because those quick hallway chats turn into advice, references, and a reality check when bills creep up. Start a simple, stubborn budget now — weekly checks, one “fun” line, and tiny habits you actually keep — and you’ll thank yourself when the surprises come.

On‑Campus Financial Services

If you’re walking across campus and smell coffee, sunscreen, and somebody else’s textbook panic, stop — because the place that can steady your wallet is closer than you think. I’ll show you the spots to use, the people to ask, and the simple moves that save cash fast. Think bright posters, quiet cubicles, friendly faces, and a calculator that actually works.

- Financial aid office: check deadlines, appeals, and emergency grants.

- Student employment: grab on-campus jobs that fit your class schedule.

- Campus bank or credit union: set up checking, low-fee accounts, direct deposit.

- Financial counseling: free appointments for budgeting, loan coaching.

- Workshops and panels: RSVP, bring questions, take notes, act.

Building Mentoring Relationships

When I first wandered into the student union looking for free pizza, I didn’t expect to find a mentor who’d change how I handled money — but that’s exactly how it starts, messy and delightful. I met Ms. Carter by the vending machines, she smelled like coffee and confidence, and she didn’t mind my nervous laugh. She taught me to ask questions, to bring receipts, to call financial aid without shame. You’ll learn to spot mentors in classes, clubs, and office hours; they’ll offer real talk, not lectures. Take notes, follow up, and return favors — bring cookies, ask about their research, listen. Mentors open doors, give pep talks, and model habits, but you still have to walk through.

Sustainable Budgeting Habits

Because I learned the hard way — by overspending on late-night fries and crying into ramen — budgeting has to be more than a spreadsheet on your phone; it needs to live in your day-to-day. I’ll keep it real: routines beat willpower. Use campus pantry runs as a grocery bootcamp, talk to a confident mentor when rent scares you, and set tiny weekly limits you can actually hit.

- Track three musts first: food, rent, transport.

- Use campus workshops, free counseling, financial aid office.

- Automate savings, even $5 makes you feel clever.

- Swap nights out for movie nights in, bring snacks that smell like victory.

- Review and tweak your plan every month, like tuning a bike chain.

You’ll build habits that stick, not stress.

Conclusion

Think of your budget as a trusty map, worn but true. You’ll check tuition, track snacks, fill out FAFSA, hunt scholarships, and haggle for used textbooks. I’ll nudge you to take campus jobs, read loan fine print, and build credit like it’s a secret handshake. You’ll talk to advisors, attend workshops, and sleep better knowing you’ve got a plan. Keep tweaking, stay curious, and celebrate small wins—this is your money, your journey.