You and I both want them to thrive, not just survive—so let’s get practical. Picture late‑night study sessions, greasy campus coffee, and that toga‑party budget panic; we’ll turn those scenes into numbers, priorities, and tiny goals that actually stick. I’ll show you how to sort essentials from flex money, use campus discounts, and build a $500 emergency cushion without turning them into a monk, and then we’ll tackle tuition timing, textbooks, and meal plans—next up, the checklist.

Key Takeaways

- Create a monthly budget together listing income (aid, jobs, family) and separating essentials from fun funds.

- Prioritize tuition and fees first: reconcile aid letters, schedule payments, and confirm refund timelines.

- Encourage delaying textbook purchases, using library copies, rentals, and campus buy/sell groups.

- Build a $500 starter emergency fund by saving a small weekly amount and replenishing after use.

- Teach banking basics: open a low‑fee student account, set low‑balance alerts, and link accounts for emergencies.

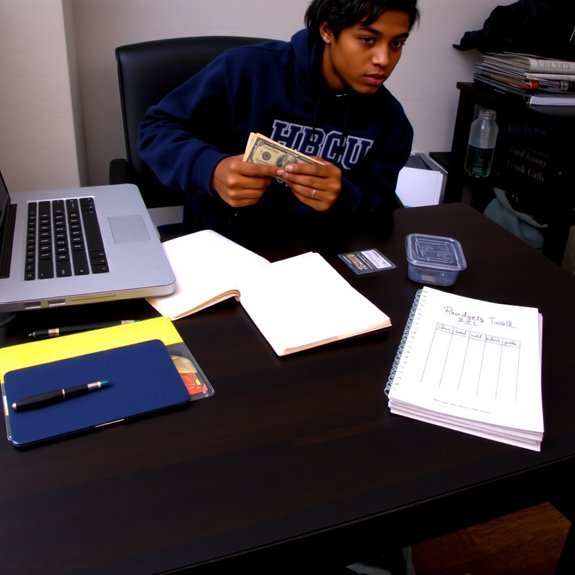

Setting Financial Goals That Reflect HBCU Priorities

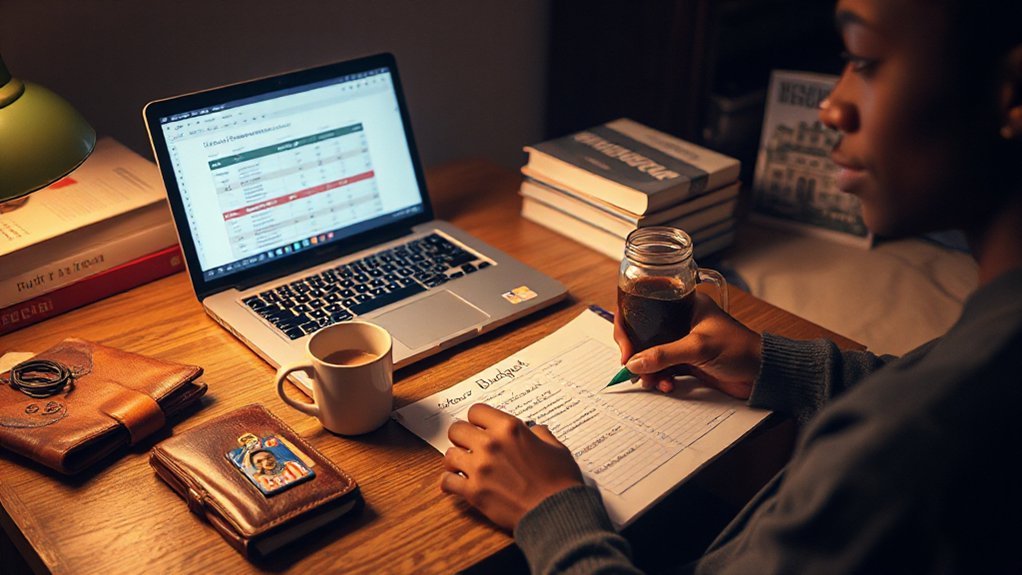

Okay—let’s get real: you can’t coach a campus budget from the bleachers. You’ve got to sit with your student, cup of coffee steaming, map out goals that fit HBCU life — legacy events, student org dues, homecoming outfits, emergency rides home. You’ll ask blunt questions, listen, jot specifics, then say the obvious things with a grin: prioritize tuition, then experiences that matter. You’ll taste the campus air, hear marching band practice, and remind them budgets fund memories, not guilt. Set short wins and a big-picture aim, label funds for culture and class, and schedule check-ins that feel like pep talks. You’ll stumble, laugh, adjust, and watch confidence grow — yours and theirs.

Creating a Realistic Monthly Budget for Campus Life

You’re going to list every monthly income source—work-study, allowance, loans, that stray Venmo from Auntie—and I’ll hold you to it, no excuses. Then you’ll split out essentials like rent and meal plans from fun stuff like late-night pizza runs, so you can actually see where money disappears; I promise it’s less scary than it looks, and smells faintly of instant ramen. Finally, we’ll set up a simple tracking-and-adjustment plan, check it weekly, and tweak things fast when campus life throws a surprise, because flexibility wins more than guilt.

Monthly Income Sources

Let’s start with three solid places most students can count on for monthly cash: part-time work, regular school aid, and a steady hand from family or guardians—yes, sometimes from Grandma’s casserole fund. You’ll track paychecks, financial aid disbursements, and gifts like they’re ingredients, tossing them into a bowl. Clock the hours you actually work, feel the cold metal of the timecard app, note deposits landing in your account. Check award letters, calendar FAFSA dates, imagine the relief when aid posts. Call home, ask about planned support, hear a laugh, negotiate expectations. I’ll say it plain: mix predictable income first, then layer in variable bits. Keep a running total, snapshot it weekly, and you’ll sleep better.

Essential vs. Discretionary Expenses

Now that you’ve mapped where the money’s coming from, it’s time to make that cash behave. You’ll split expenses into must-haves and nice-to-haves, plain and simple. Essentials feed survival: rent that smells like new paint, groceries that actually fill the fridge, textbooks you can’t skip. Discretionary buys sparkle — late-night pizza runs, concert tickets, that hoodie you’ll wear twice. Be honest, you’re human, you’ll want both. I suggest a simple rule: cover essentials first, tuck a little into savings, then allocate pocket money for joy. When temptation sings, picture your empty bank app. Decide ahead, so choices feel deliberate, not desperate. Small trades now buy big calm later.

- List essentials: housing, food, tuition supplies

- Discretionary examples: dining out, subscriptions, extras

- Quick tip: set limits, review monthly

Tracking and Adjustment Plan

Three simple steps, a little honesty, and your bank app stops feeling like a horror movie. I want you to track every swipe this month, phone buzzing, receipt crumpled, latte gone cold. Log rent, food, laundry, late-night Uber, that impulse tee—nothing’s off-limits. Check totals weekly, don’t wait for panic Sunday night. When a category blows past the plan, adjust: cut one streaming service, pack lunches twice a week, or shift gift money to essentials. I’ll show you how to tweak percentages, but you’ll decide what feels fair. Set one small reward, keep it visible, celebrate tiny wins. Repeat monthly, compare trends, laugh at past mistakes, and slowly make your budget predictable, sane, and kind to your future self.

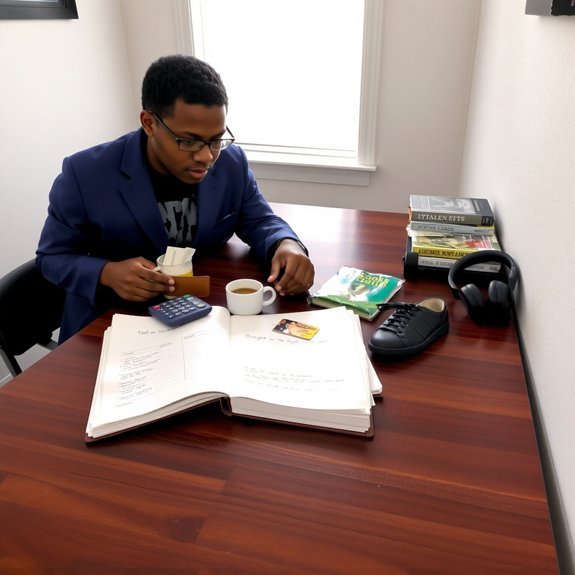

Teaching Basic Money Management and Banking Skills

You’ll want to start by opening a student account, the kind with low fees and a handy mobile app so they can tap, swipe, and actually see where their money goes. Have them track spending for a month—receipts, screenshots, guilty late-night pizza orders—so the numbers stop being a mystery and start being a plan. I’ll show you simple ways to compare accounts, set alerts, and turn those messy habits into smart money moves.

Open a Student Account

Open a student bank account early — trust me, it’s the tiny victory that makes dorm-life less chaotic and pizza cravings less tragic. You’ll feel lighter the first time you tap a card instead of digging for crumpled bills, and that little beep is oddly satisfying. Pick a campus-friendly bank, bring your ID, student info, and a smile. Ask about fee waivers, mobile deposits, and ATM networks so you won’t hunt a machine at midnight. I’d open checking for daily use, savings for rainy days, and link a parent or guardian for emergencies.

- Compare student fee waivers and rewards.

- Set up mobile alerts for low balances.

- Request a chip card and free online access.

Track Spending Habits

If you want to stop gasping at your bank app every Sunday night, start by watching where your money actually goes — not where you think it goes. I want you to log every purchase for two weeks, receipts, taps, and that suspiciously frequent coffee run. Use a free app or a simple spreadsheet, whatever you’ll keep up with. Look, you’ll find patterns: late-night delivery, impulse Amazon hits, too many rideshares. Say it out loud, “I bought three hoodies I never wear.” That’s progress. Set tiny rules — no takeout after 10 p.m., one streaming add-on max — and test them. Reconcile weekly, celebrate small wins with a cheap treat, and tweak. Tracking isn’t perfect, but it teaches choices, fast.

Managing Tuition, Financial Aid, and Scholarship Funds

When tuition bills start landing like heavy postcards in the mailbox, don’t panic — we’ll sort it out together, one sensible step at a time. I’ll walk you through balancing aid, scholarships, billing deadlines, and the little surprises that hide in fee lines. You’ll check deadlines, set alerts, and call the bursar with a calm voice, not a scream. Feel the paper, read the fine print, then type into your calendar.

Tuition panic? Breathe. We’ll tackle aid, fees, deadlines, and refunds calmly—check, call, calendar, repeat.

- Confirm refund timing so you’re not waiting on an empty account.

- Reconcile award letters, prioritize grants over loans, ask about appeals.

- Track disbursements, document contingencies, set a small emergency cushion.

You’ll handle this. I’ll be the nudge you need, slightly sarcastic, always practical.

Controlling Textbook and Course Material Costs

Because you’ll spend less time angry and more time learning if you stop buying every shiny textbook on Day One, let’s hack the chaos of course materials together. I’ll tell you straight: don’t assume the syllabus equals necessity. Wait for day two, ask the professor what’s required, and check if a library copy, course reserve, or older edition will do. Compare rental sites, buy used, and scout campus buy/sell groups — they smell faintly of coffee and victory. Try digital access only when it’s cheaper, or split bundle codes with a roommate, awkward but effective. Use library scans, open educational resources, and professor handouts. Track receipts, return unused books, and celebrate small wins, because saving $50 feels like winning the lottery.

Balancing Housing, Meal Plans, and Off‑Campus Living Expenses

Alright, you’ve mastered the textbook scavenger hunt and kept your bank account from crying — now let’s talk roof, food, and the tiny wars over who washes the dishes. You’ll weigh on‑campus convenience against off‑campus freedom, sniff the cafeteria mystery meat, and decide if late‑night pizza trips beat a meal plan. I’ll walk you through real choices, sensory details and quick math so you can pick what fits.

You’ve survived textbook hunts and budget panics — now juggle roof, food, chores, and midnight pizza debates.

- Compare costs: rent, utilities, commuting, plus the smell of instant ramen vs chef’s salad.

- Check meal plan swaps: guest passes, rollover meals, peak‑hour lines and taste tests.

- Split bills smart: set rules, automate payments, and schedule chore rotations before drama starts.

Building Emergency Savings and Handling Unexpected Costs

If you think emergency savings are boring, you haven’t tried scraping together cash at 2 a.m. with a broken phone and a parking boot, and trust me, that panic-sweat is less than fun. You need a tiny, sacred fund, hidden from your regular spending, because life throws curveballs — flat tires, surprise lab fees, midnight courier runs. Start by saving $5 or $10 a week, stash it in a separate account or an app, and treat it like rent: non-negotiable. When the emergency hits, breathe, list actual costs, pay what’s urgent, then replenish the fund within weeks. Keep receipts, learn quick fix skills, and set a $500 starter goal. Small habits beat dramatic rescues, every time.

Leveraging Campus Resources, Mentors, and Alumni Networks

Saving a five-dollar bill every week is great, but you don’t have to be a lone squirrel stuffing nuts under the mattress — campus is full of grown-up squirrels waiting to help. I’ll show you where to tap them. Walk into the financial aid office, smell the recycled coffee, ask for aid workshops, and take notes. Find faculty office hours, introduce yourself, say “I’m budgeting” like it’s a cool club, get tips. Join student orgs, hear alumni guests tell real stories, trade contacts. Mentors open doors, alumni send internships, staff point to grants you missed.

- Visit financial aid and career centers for workshops and listings.

- Ask professors and advisors for planning and referral help.

- Network at alumni panels, collect contacts, follow up.

Encouraging Smart Spending While Still Enjoying Campus Culture

Because campus life shouldn’t feel like a math test you’re failing, I’ll show you how to spend smart without missing out — yes, even on those late-night food truck runs and homecoming parties. You’ll learn to sniff out deals, compare prices, and still savor the smell of fries at midnight. I’ll push you to set a fun fund, split costs with friends, and choose signature events over every impulse invite. Picture texting “Who’s bringing snacks?” instead of buying solo. Sample campus coffee, skip premium add-ons, grab student discounts, and barter favors for tickets. You’ll feel proud, not deprived, because you picked memories and clever choices, and yes, you’ll still dance at homecoming.

Conclusion

You’ve got this — sit with your student, listen, then make a plan you’ll actually follow. I once helped Jamal, who skipped ramen for three weeks to buy a used textbook and still made Homecoming — we laughed, he learned, his GPA survived. Set clear goals, track every dollar, use campus help, and trade nights out for potluck wins sometimes. It’s practical, kind, and totally doable; you’ll both sleep easier, promise.