You’re staring at a paper full of numbers, and I get it — it looks like alphabet soup, but it’s actually your roadmap; lean in, squint at the tuition line, smell the ink (yes, I said smell), and map out what’s free money versus what you’ll owe later. I’ll walk you through grants, loans, work-study, renewal catches, and the deadlines that sneak up like campus squirrels—so keep that offer handy, because next we strip it down line by line.

Key Takeaways

- Identify the Cost of Attendance components (tuition, fees, room, board, books) to know the full price before aid is applied.

- Separate gift aid (grants, scholarships) from loans and note renewal rules or GPA and credit-hour requirements.

- Check whether federal work-study is included and understand eligibility, weekly hour limits, and typical campus job types.

- Compare subsidized versus unsubsidized loans, interest rules, and repayment options before accepting any borrowed funds.

- Track deadlines, ask the financial aid office specific questions, and use a net-price comparison spreadsheet to decide.

What’s Included on an HBCU Financial Aid Offer

Envision this: you’ve got a folded letter in your lap, the campus brochure still stuck to your shoe, and now it’s time to decode the financial aid offer like it’s a secret menu. I’ll walk you through the parts so you’re not squinting at fine print like it’s a mystery novel. First, there’s your cost of attendance — tuition, fees, room, board, and an estimate for books; feel the paper, that number’s the headline. Then you’ll see types of aid listed: loans, work-study, and institutional awards, each with amounts and strings attached. Look for award year, enrollment status, and renewal rules. Check deadlines and contact info, because you’ll want quick answers, not voicemail suspense.

Understanding Grants and Scholarships

Think of grants and scholarships as the free stuff in your financial aid basket — shiny, no-strings-attached (mostly), and exactly what you want first. I’ll tell you how to spot them: look for words like “grant,” “scholarship,” “gift aid,” and amounts that don’t need repaying. Run your finger down the offer, yes literally, and mark federal Pell, state grants, and school awards with a star. Read the fine print — renewal rules hide in small type, deadlines whisper like sneaky elves, GPA or credit-hour requirements can yank money away next year. Ask financial aid, pronto, if anything’s unclear; they’re human, and usually helpful. Treat grants as priority, scholarships as trophies, and never assume they’ll automatically renew.

Decoding Work-Study and Employment Options

You’ll meet a mix of on-campus jobs — front-desk reps, lab assistants, dining staff — each with different hours and pay that you’ll want to compare like a menu. I’ll walk you through who qualifies, how many weekly hours you can pick up, and what shows up on your paycheck so you’re not surprised at tax time. Trust me, it’s less scary than it sounds, and I’ll keep it practical, honest, and a little bit funny.

On-Campus Job Types

Alright, let’s talk jobs on campus — the ones that actually pay you, not just boost your résumé. You’ll find a handful of clear options: library attendant shelving books, IT help-desk answering frantic “my Wi‑Fi died” texts, dining-hall server carrying trays that clatter, lab assistant prepping glassware and notes, and administrative clerk filing forms while gossiping softly at the copier. Some gigs are public-facing, loud, fast; others are quiet, steady, behind-the-scenes. You’ll touch real things, hear fluorescent hum, smell coffee, feel keys under your fingers. I’ll say it straight: choose what fits your schedule and stamina. Try a couple, keep what pays and teaches, ditch what drains you. You’ll earn cash, skills, and maybe a co‑worker who knows your coffee order.

Eligibility and Hours

You found a job that fits—maybe the help desk that smells like burnt coffee, or the lab with its weird clang of glass—and now you need to know if you can actually work there. First, check eligibility: are you a work-study awardee, or does the position accept all students? Peek at FAFSA notes, your financial aid portal, or ask the financial aid office—don’t guess. Look for enrollment requirements, GPA minimums, and citizenship or visa rules. Next, hours: federal work-study limits and campus policies usually cap weekly hours so school stays first. Think: class schedule, commuting, sleep. Get a written schedule, talk to supervisors about exam weeks, and confirm maximum term earnings. You’ll avoid surprises, and keep your sanity intact.

Pay, Payroll, Taxes

Let’s untangle pay, payroll, and taxes before your first paycheck winks into your bank account—because nothing kills the glow of campus victory like a surprise tax form. I’ll walk you through hours, hourly rates, and pay cycles so you don’t squint at a stub wondering where your loaf of ramen went. You’ll clock in, they’ll run payroll—biweekly or monthly—deducting FICA, federal, maybe state taxes, and sometimes benefits. Keep my voice in your ear: submit timesheets early, check direct deposit, and save one paycheck for a celebration taco. If you’re work-study, earnings don’t reduce grants, but they do show up on taxes; ask HR about tax withholding forms, and file a simple return. Small effort, big peace of mind.

Comparing Loan Types and Repayment Terms

Before you sign anything, take a breath and let’s make loan-speak feel like plain English: loans come in flavors — federal, private, subsidized, unsubsidized — and each one smells, tastes, and sticks to your wallet differently. You’ll want federal first, usually, because they offer lower rates, flexible repayment, and forgiveness options if life throws you curveballs. Subsidized loans don’t charge interest while you’re in school, that’s a sweet relief. Unsubsidized start accruing interest immediately, so think twice before biting. Private loans can be tempting, like shiny candy, but they vary in terms and often need a co-signer, yikes. Look at interest type, rate, capitalization, repayment plans, deferment rules, and penalties. I say compare totals, not monthly teasers.

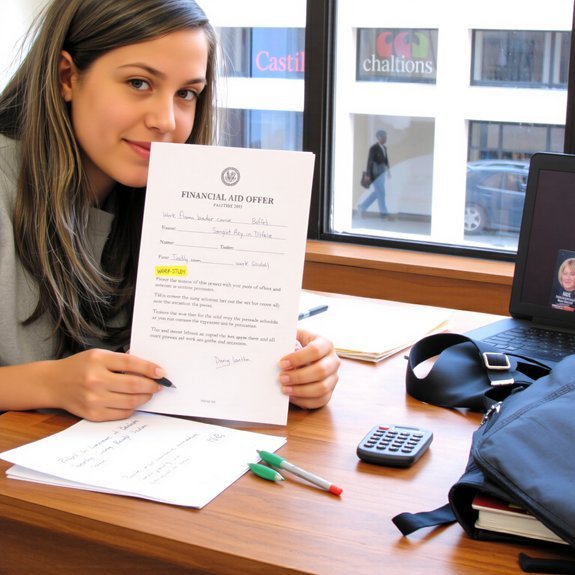

Recognizing Institutional and Program-Specific Awards

You’ll spot institutional grants first, those campus-funded awards that shrug your tuition bill down and glow like a neon sign on the offer letter. I’ll point out program-specific scholarships next — the ones tied to majors, clubs, or research, that might require auditions, portfolios, or a quirky application essay; they’re more like secret doors than blanket discounts. Keep your eyes sharp, ask admissions for the fine print, and don’t be shy about calling them out when the numbers don’t match the sparkle.

Institutional Grant Types

Think of institutional grants as your college quietly sliding you a scholarship-sized envelope across the table — I’ll show you how to read what’s inside. You’ll see merit grants, need-based grants, residency discounts, and talent awards listed with amounts, terms, and renewal rules. I point, you squint at the fine print. Merit means they liked your grades, need-based reacts to your FAFSA, residency trims tuition for in-state students, and talent ties to sure-footed extracurricular chops. Note whether amounts apply per year, per semester, or to tuition only — that matters, trust me. Watch for renewal GPA bars, service obligations, or stacked limits. Read deadlines aloud, circle them, email the aid office if anything smells off. Claim what’s yours.

Program-Specific Scholarships

Okay, now let’s pull those institutional grants closer and scan the margins for program-specific scholarships — the little VIPs tucked inside departments, clubs, and special programs. You’ll spot them like secret backstage passes: a music department award that smells faintly of piano polish, a STEM stipend tied to lab hours, a marching band scholarship that hums in your bones. I’ll tell you straight: these often stack, they usually ask for real work, and they want commitment, not just hope. Check deadlines, contact faculty, and show up — literally, knock on doors, send succinct emails, bring a resume. I poke fun, but these are gold. Treat them like hidden treasures, dig smart, and claim what’s yours.

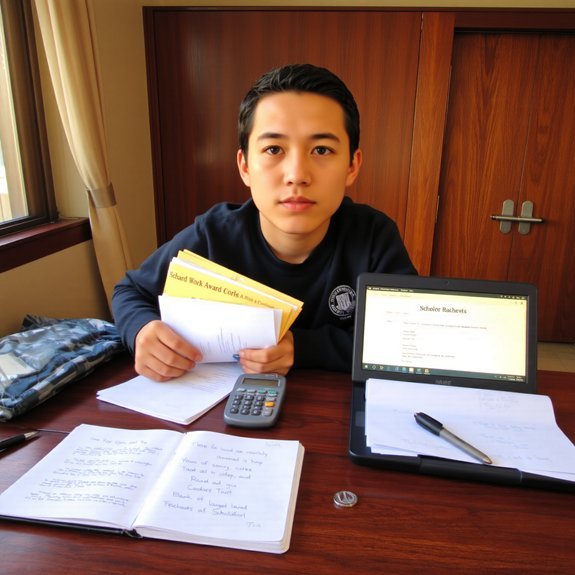

Identifying Deadlines, Conditions, and Renewal Rules

When’s the last date you can sigh in relief and call your financial life “handled”? I’d tap the calendar, maybe smell coffee, and circle that deadline in angry red. Check dates for accepting awards, completing paperwork, and returning signed forms — they’re your stopwatches. Note conditions: maintain a GPA, enroll full-time, or keep a major, or the money vanishes like a bad joke. Renewal rules tell you if aid continues next year, and what hoops you’ll jump through. Write deadlines on your phone, set two alarms, tell a friend to nag you. Keep copies of emails and submit transcripts on time. Miss one date, and you might be paying out of pocket — I’d rather not test that.

Questions to Ask the Financial Aid Office

How do you even start that conversation without sounding like you’ve teleported from Planet Clueless? I shrug, clear my throat, and ask: what’s fixed and what can change? Then I jot down follow-ups: which scholarships require extra forms, when do they expire, and who signs off on appeals? I lean in, smell coffee, and ask about bundled aid—does work-study reduce loans? I say, “If my hours drop, what happens?” I write down contact names, office hours, and preferred email templates. I ask for examples of successful appeals, and whether awards shift mid-year. I request a written breakdown, plain language, please. I leave smiling, pockets heavier with clarity, knowing I’ve turned confusion into a usable plan.

Side-by-Side Comparison Tips and Decision Tools

You’ve already asked the smart questions in the aid office, so now we play spreadsheet spy. I want you to open a fresh sheet, name columns: Cost, Grants, Scholarships, Loans, Work-Study, Net Price, Notes. Color-code rows per school, make them pop like sticky notes. Add a column for “Must-Haves” — things you won’t compromise. Crunch numbers out loud, say them, hear the gravity. Tap into calculators for monthly loan payments, taste-test the math. Compare deadlines, housing vibes, meal plans, commute time; write tiny sensory notes — crisp dorm air, cafeteria scent. Use a decision matrix: weight what matters, score each school. When stuck, call family or a mentor, read their voice, then trust your spreadsheet and gut.

Conclusion

You’ve got this. Nearly 40% of HBCU students rely on federal grants, so reading your offer can actually change your budget, not just your mood. Sit down, spread the paper out, trace the numbers with your finger, and ask: “Does this cover my rent?” Call the aid office, take notes, and don’t be shy. I’ll cheer you on—coffee in hand, calculator ready—because smart questions save real money.